Jurriaan Schrofer

11 March, 2020

But how exactly does the NOW work? And is the arrangement sufficient? Below we list the pitfalls and show why the arrangement sometimes sounds nicer than it really is. If you have any questions, you can always call us for advice on 06 14 79 68 41 or email us at joris@eitje.app.

The NOW in brief

The myth of 90%

The pitfalls

Things that get in the way

Request NOW

About egg

Under the new scheme, companies will be reimbursed a maximum of 90% of their wage costs. The scheme is primarily intended to ensure that your employees continue to be paid, not to save your catering business. Therefore there are two hard conditions :

Despite the closure of your catering business, you continue to pay your employees.

During the subsidy period, you do not fire personnel for economic reasons.

The amount of the allowance is determined as follows:

The gross wage bill of January 2020 (for no wage bill in January, they look at the wage bill for November 2019). For example € 10,000.

The wage bill will be increased by 30% to cover additional personnel costs, such as holidays, allowances and social security contributions. In our calculation example, this amounts to € 10,000 x 1.3 = € 13,000.

The compensation is X percent of this amount, where X is the expected loss of turnover and a maximum of 90%. In our calculation example this is therefore a maximum of 0.9 x € 13,000 = € 11,700 per month.

80% of this amount is advanced, so 0.8 x € 11,700 = € 9.360.

The other € 2,340 will be paid later, after the final loss of turnover has been determined. It will then look at how much you should actually get, whether you are entitled to even more and whether you have already received too much – if so, you must repay the excess.

Here you can download the apply for a scheme and here you will find the answer to frequently asked questions .

The myth of 90%

Politicians speak of a large-scale support package, with which catering businesses are reimbursed 90% of their wage costs. With a simple calculation, catering entrepreneur Won Yip see that this is unfortunately not quite correct.

The NOW adds 30% to the gross wage bill to “ to compensate for costs such as employer contributions, employee contributions to pension and the accrual of holiday pay ” † Then you get a maximum of 90% percent of that, so a maximum of 0.9 x 1.3 = 1.17 x the gross salary.

Yip shows that employee expenses are more than 130% of gross wages. If you look at the calculation example below, you will see that the re ë The personnel costs actually amount to 153.95% of the gross salary.

This is own contribution of 154 - 117 = 37 In other words: 24% of the wage costs. With the NOW scheme you will therefore be reimbursed a maximum of 76% of your total personnel costs, not 90%.

The pitfalls

Due to a number of pitfalls, most catering businesses do not receive full compensation:

You only receive the maximum amount if you convert has fallen to 10% or less. If you convert with “ only ” 30% has decreased, you only get 0.3 x 1.3 = 39% of your gross wage costs. That is just under 25% of your total wage costs (39 / 154 * 100 = 25%).

The wage costs are calculated on the basis of January, while January is one of the quietest months in the hospitality industry. That is why the advance may be insufficient to pay your staff.

Before you receive the last 20% of your compensation, we look at the total loss of turnover in the months of March/April/May. But the catering industry was not closed until mid-March. If you assume that a catering business has had normal turnover in the first two weeks of March, this amounts to a maximum loss of turnover of 11/13 = 85%. As a result, you are not entitled to the maximum subsidy.

Seasonal businesses, for example some of the beach bars, didn't have any sales in January, but should be full by now. The UWV calculates the allowance with “ with your definitive loss of turnover, and with your average wage bill for March, April and May 2020. Is this higher than the wage bill for January? Then we use the wage bill for January. ” If in January é had no wage costs in November, so you are not entitled to the NOW scheme.

Businesses that are having a hard time

Some catering businesses will survive the corona crisis, others will not. The Dutch hospitality landscape is competitive and, with high personnel costs and low margins, difficult to survive in. The corona crisis and subsequent recession can kill many things.

Certain catering businesses will have more trouble surviving:

Catering businesses that were not doing so well. If your catering business could barely make ends meet in the past year, you most likely have no reserves. In addition, many of your costs continue as usual. It will be difficult to continue to cover your costs without turnover.

Catering businesses that started recently. Opening a catering business requires a significant investment, including renovation, the purchase of tools and equipment, the initial purchase and marketing. That's why it usually takes é é one or two years before a catering business can make a profit. If you have not yet been able to make a profit, but are faced with high costs, you have no reserves to cover them with.

Catering establishments with high fixed costs and loans. For the time being, you will not be compensated for your rent and outstanding loans. If you do have to pay it, but you don't have any turnover to pay for it, it becomes difficult to make ends meet.

Request NOW

If you want the NOW applications do you need á keep track of all NOW hours. Those are the hours not worked that you will be paid.

Because this can be a tedious and labor-intensive task, we have developed a free NOW tool. With this you can easily write and keep track of the NOW hours, so that you receive the amount to which you are entitled. You can sign up here for the free tool.

If you have any questions about the NOW, we are happy to help you. You can reach us on 06 14 79 68 41 or at joris@eitje.app.

About eitje

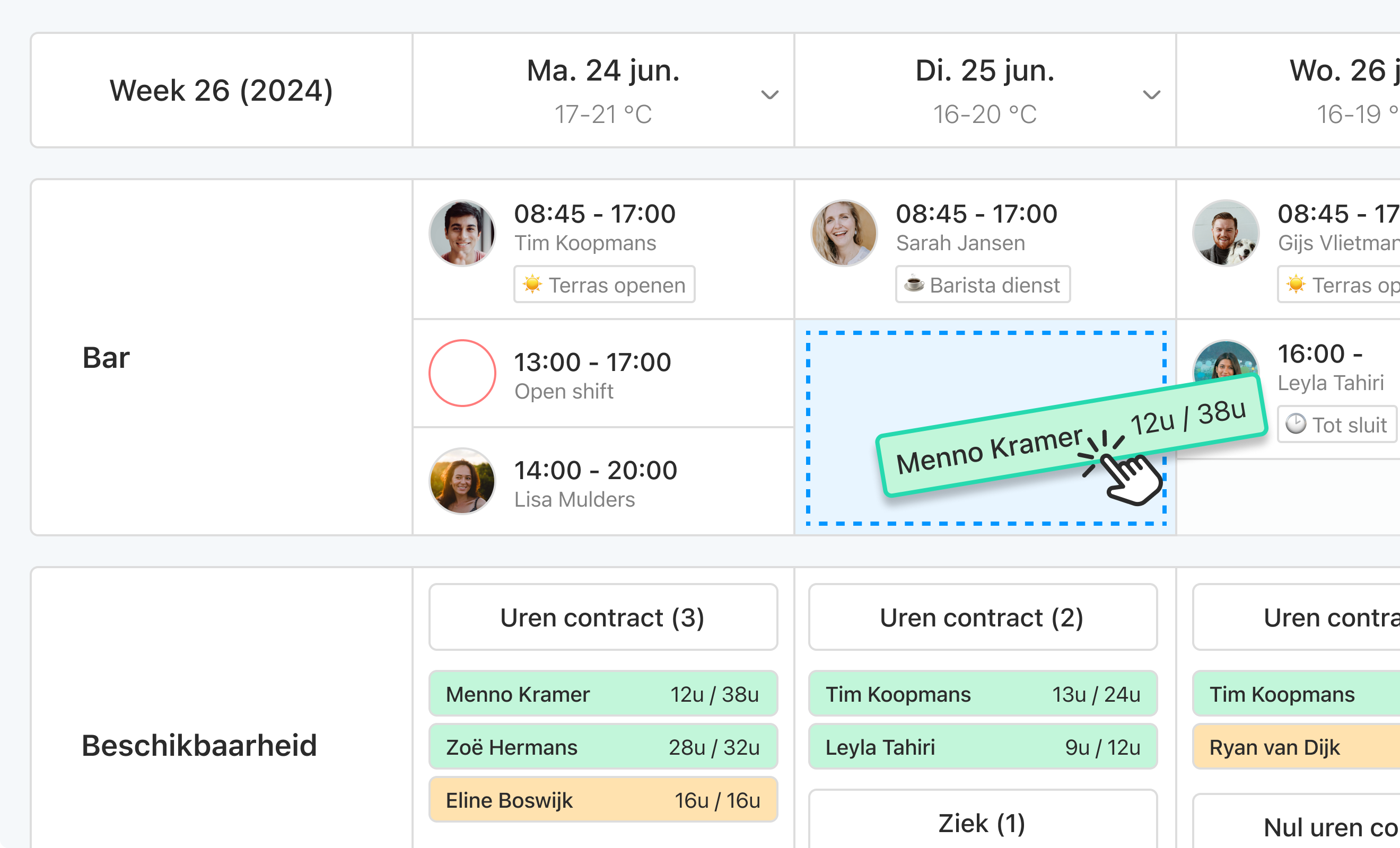

Eitje is an online planning tool for the hospitality industry, with which you among others registers hours and links them to your payroll administration. We understand that this is a difficult time, so we offer you to use egg for free until the corona crisis is over. Create an account here .

Eitje

Alles voor je team in één oplossing

De beste en makkelijkste manier om teamleden aan te sturen. Roosters, communicatie, urenregistratie en meer.